Pharmacovigilance as an integral part of hospital Quality Management Systems

Veronika Valdova • November 18, 2019

Rethinking post-market drug safety surveillance

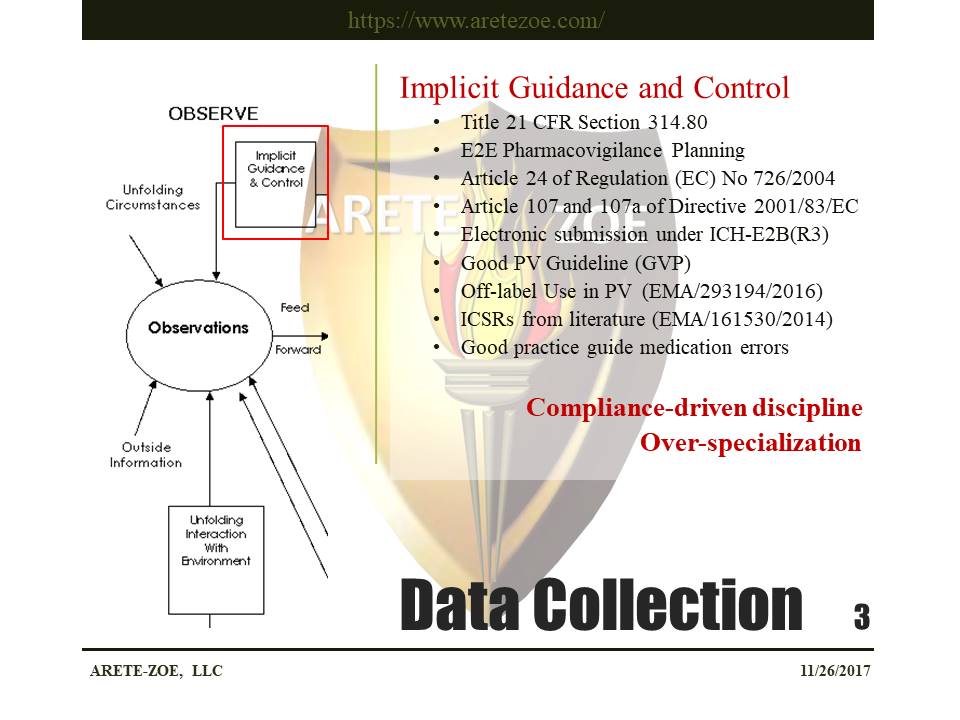

Regulatory requirements are the primary drivers of drug safety surveillance activities. The desire is to avoid adverse consequences stemming from non-compliance.

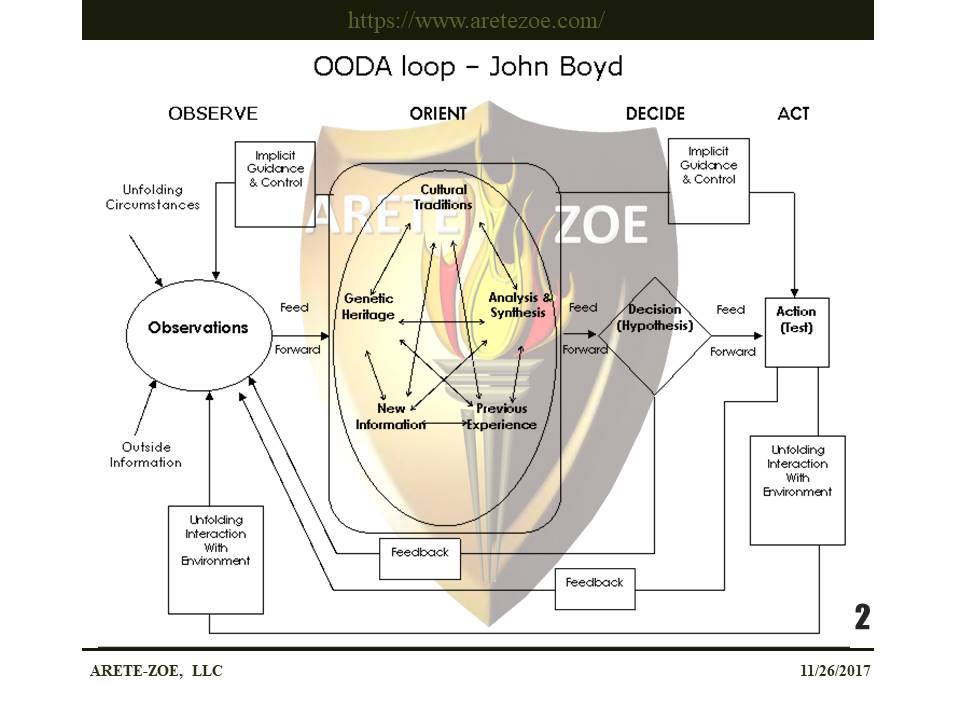

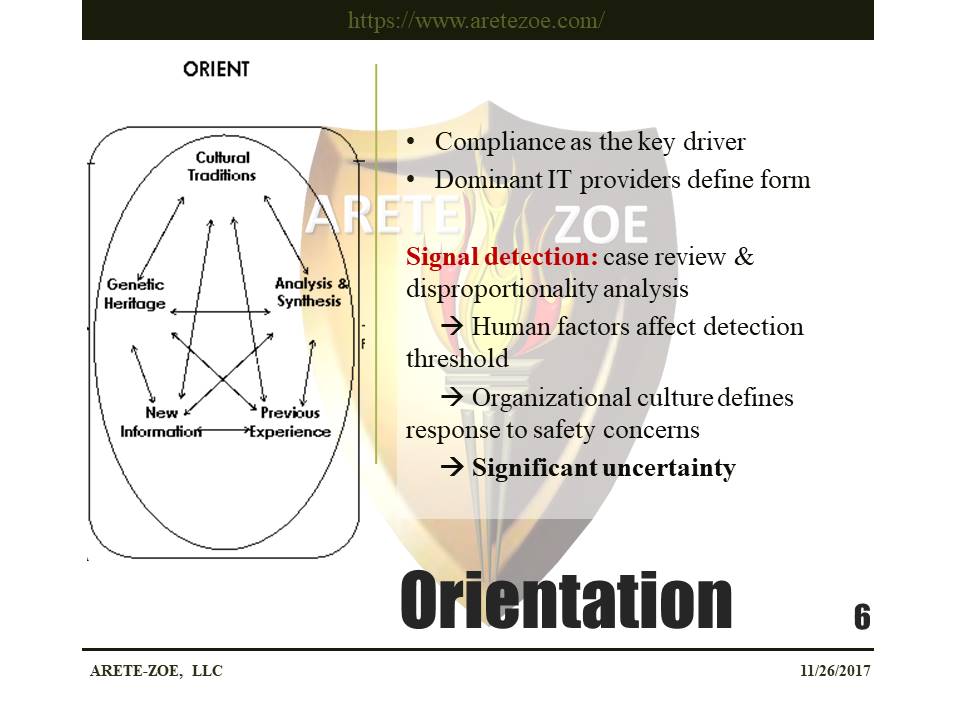

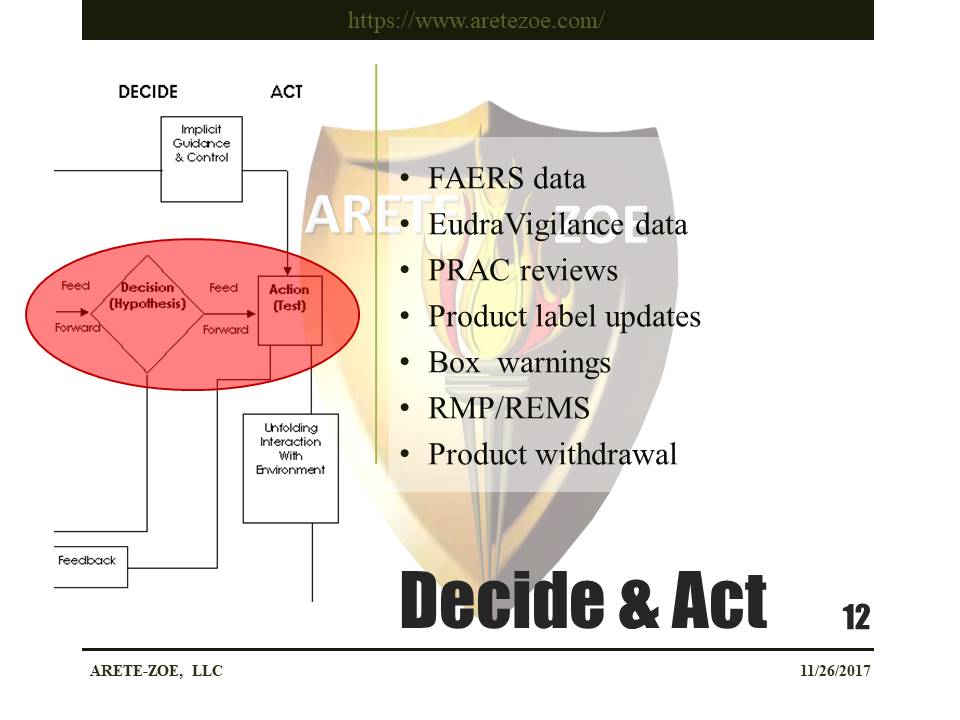

Boyd cycle, or OODA loop, explains fundamental principles of decision-making loop based on observation, orientation, decision, and action. Observation part of the loop follows requirements detailed in law and regulations and consists of a systematic screening of defined sources for specific information about marketed drugs. Collection of Individual Case Safety Reports (ICSRs) is a very structured process that conforms to the established industry standard limited by dominant technology providers for the processing of these cases. Outsourcing and off-shoring of critical operations bring different cultural traditions. The same information in the same context will be evaluated differently depending on individual background. Risk-perception or communication of safety concerns or potential risks depends on cultural traditions and the norms of acceptable behavior. Information collected during pharmacovigilance activities is used to update product labels and in extreme cases, may lead to the withdrawal of a product from the market and adjust prescribing behavior and clinical decisions in the treatment of individual patients.

The scope of pharmacovigilance activities defined in regulations and guidelines. The sole desire to comply with rules does not necessarily ensure full situational awareness and a complete and objective picture of the drug’s safety profile. Examples of post-market surveillance failure include diabetes drug Avandia or anti-inflammatory drug Vioxx. The sole focus on accuracy, completeness, and correctness of data within a very narrow scope results in overspecialization that further limits the organization’s ability to appreciate the full picture.

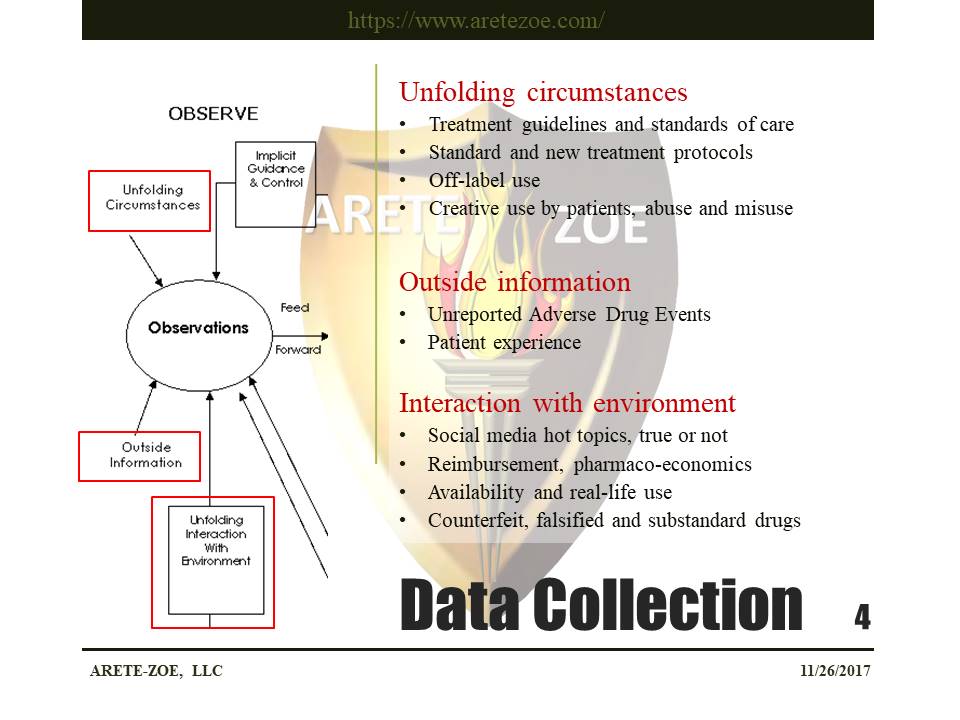

Uptake of new drugs and technologies into clinical practice depends on the target population, the disease, and other drugs available to treat the condition, pharmacoeconomic evaluations, reimbursement rules, and other factors. New drugs become part of standard treatment protocols based on an assessment by professional societies and often prescribed in ways that were not originally anticipated or intended. One such example is the intravitreal use of bevacizumab (Avastin). Many new oncology drugs are used in patient populations that were not part of clinical trials, to treat a wide variety of different tumors and in combinations untested in clinical trials. Information from real-world use would be especially valuable when the post-authorization patterns of use differ significantly from the use tested in clinical trials. Patient creativity, as influenced by information spread via informal channels, including social networks, compounds the problem. In the U.S., only a fraction of adverse drug events are reported to FAERS directly by health professionals; 95% of all reports come in from the industry. Another unknown lies in the presence of counterfeit and substandard medications in some markets. All this information can affect the assessment of the causal relationship between the drug and the event.

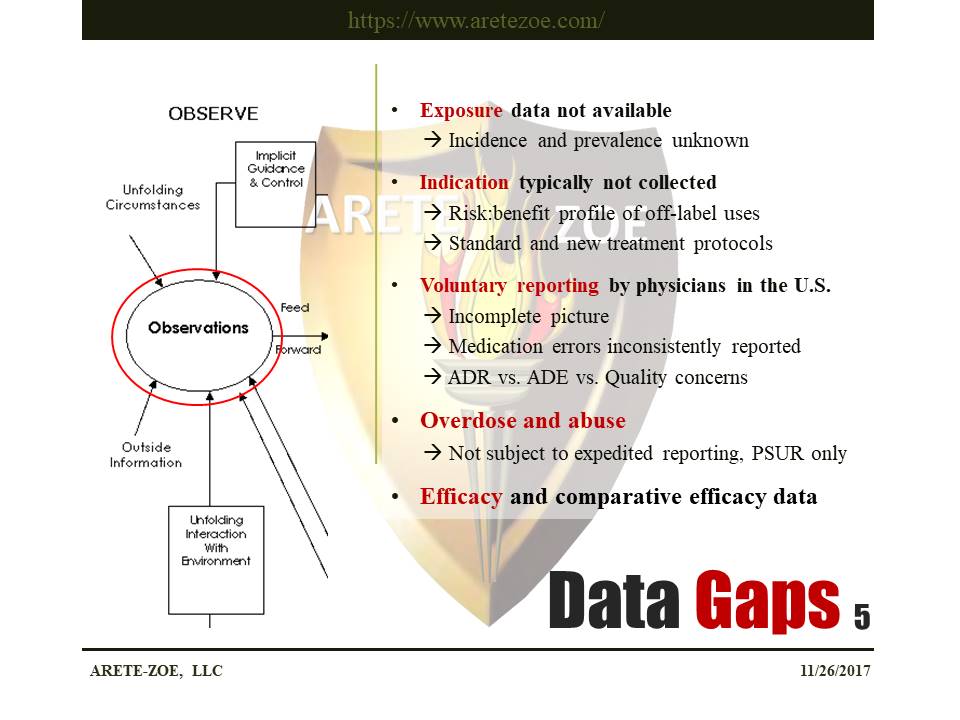

The most significant limitation of data collected after authorization is the fact that there is no baseline, no exposure data, to which the data on adverse drug reactions can relate. The current post-market safety surveillance systems cannot detect the incidence and prevalence of adverse drug reactions and change in trends. Neuropsychiatric reactions to antimalarial medication mefloquine are an example of this shortcoming. While the adverse reaction itself is known, the actual rates of occurrence are unknown. The drug first caused concerns in 2002 at Fort Bragg, N.C., after a series of violent incidents. In 2004, the Army requested a study into a comparative rate of adverse effects of mefloquine. Exposure data help by the Army were critical to the understanding of the true extent of the problem.

The extent of off-label use complicates the assessment of Benefit: Risk profile of medications. Benefit: Risk profile of a drug depends on the context of its use, and it is impossible to evaluate if data on total exposure and indication are not available. Newly launched medicines, especially in oncology, become part of treatment protocols for cancers and in populations for which they were not tested. The benefit: risk profile of such combinations is impossible to establish from passive post-market surveillance.

And finally, the risk of overdose and abuse is impossible to detect in real-time since cases of overdose are typically not subject to expedited reporting and only need to be included in periodic reports.

Orientation is a critical part of the decision-making process. Nature and nurture affect our ability to detect and communicate safety issues before they become self-evident. Different types of intelligence play a role – recognition of patterns, risk-assessment, as well as the ability to deliver the message to the leadership without endangering own career. In the pharma industry, teams are often built to avoid personality clashes and ensure smooth function in the office environment. Education, training, personal values, and individual biases affect reasoning and perception of risk.

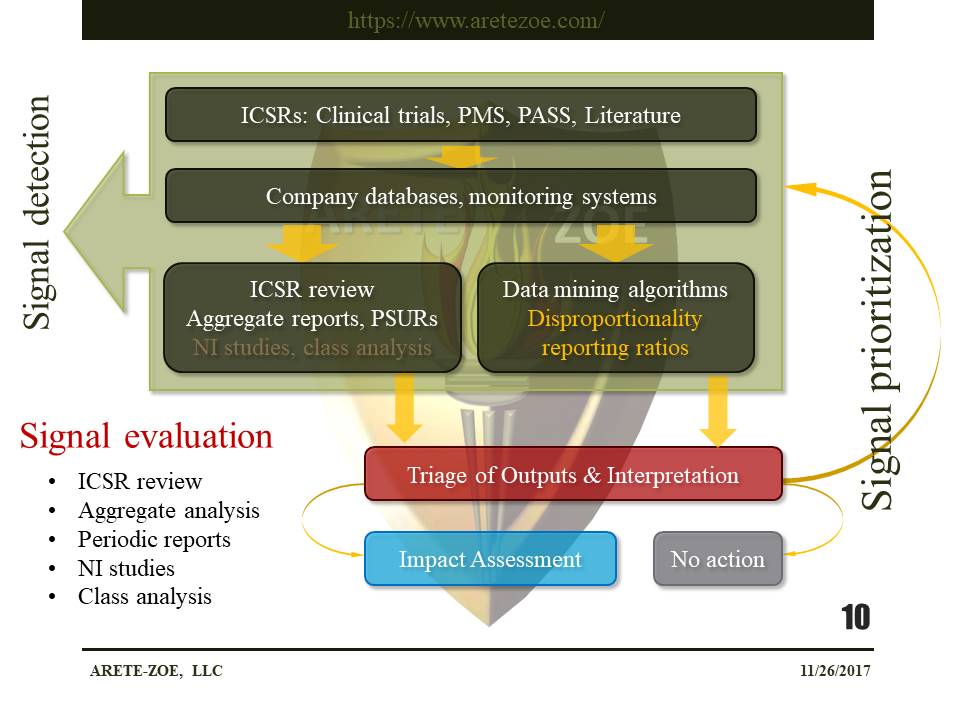

In pharmacovigilance, the main barriers to accurate and timely orientation result from the detailed regulation that emphasizes form at the expense of purpose. Dominant IT providers in the industry designed their products to comply with regulatory requirements to the letter. The methods used in the detection of safety signals rely on the comparison of the review of a single case or a case series and disproportionality analysis. These techniques lack the power to detect true rate, incidence, and prevalence of events due to the lack of exposure data. These methodologies make the detection of safety signals and evaluation of benefit: risk profile very subjective.

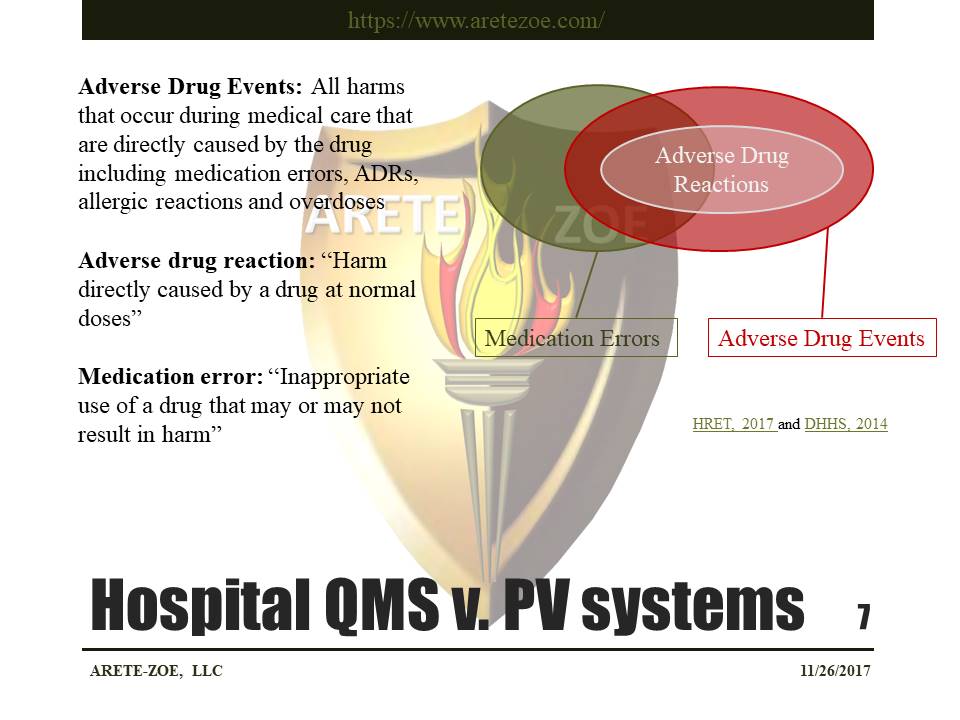

The difference between pharmacovigilance and quality management systems in inpatient and outpatient healthcare settings is the nature and purpose of the information collected. While drug safety surveillance systems are primarily designed to collect information on adverse drug events, hospital quality management systems exist to collect information that measures the quality of care. Quality management systems in hospitals collect all events, including adverse experiences relating to drugs and medication errors.

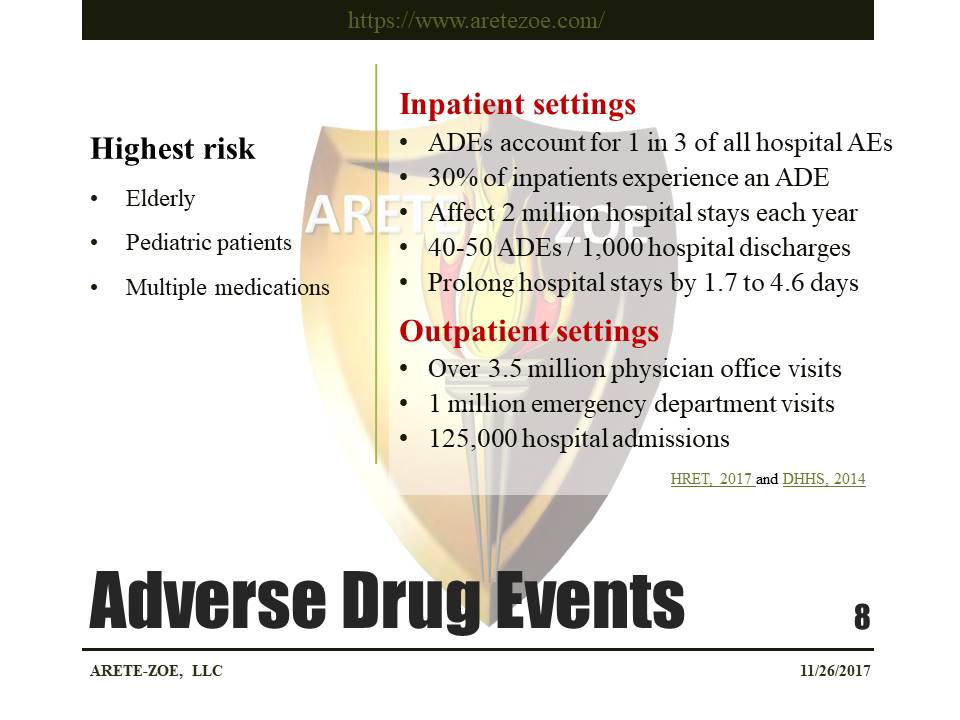

Hospitals in the U.S. collect a variety of information on adverse drug events as part of the monitoring of the quality of care they provide. A study of Medicare beneficiaries revealed that 30% of inpatients experienced an adverse drug event in 2011. This figure amounts to 1.9 million ADEs in inpatients a year, ranging from no harm to death. The risk of ADEs increases with age and number of medications. Participation in Hospital Engagement Network Initiatives led to the reduction of ADEs from 49.5 events per 1.000 hospital discharges to 41.4 ADEs. Pediatric patients and the elderly are particularly at risk, along with patients on multiple medications.

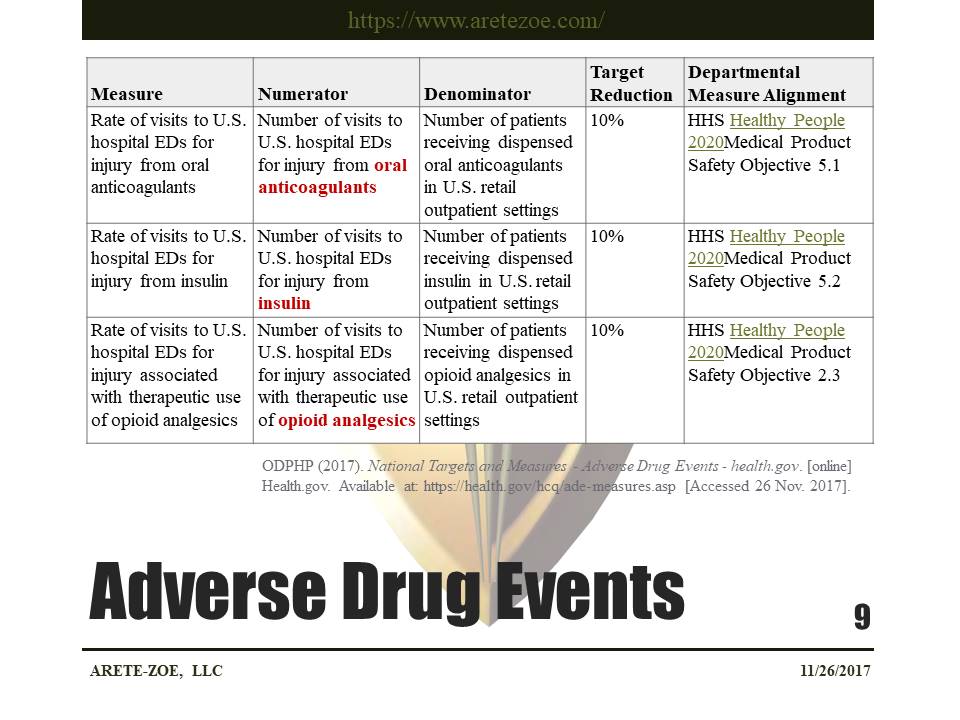

The highest number of adverse drug events in inpatient settings can be attributed to insulins, anticoagulants, and opioid analgesics. The National Action Plan, therefore, focuses on the reduction of the rate of emergency department visits for injury associated with the therapeutic use of opioid analgesics, insulins, and oral anticoagulants. The number of emergency department visits for injury from a specific drug serves as a numerator, and the number of patients receiving the drug serves as a denominator.

Signal detection in pharmacovigilance relies primarily on the review of individual case reports and case series. Another method is a disproportionality analysis of data reported in corporate databases. Actual incidence, prevalence, and rate are impossible to establish due to a lack of exposure data. Market Authorization Holders are now encouraged to implement multi-regional PASS as part of post-market surveillance activities. The objective of conducting post-authorization safety studies (PASS) is to gather additional safety information, assess patterns of drug utilization, to measure the effectiveness of a risk minimization activity.

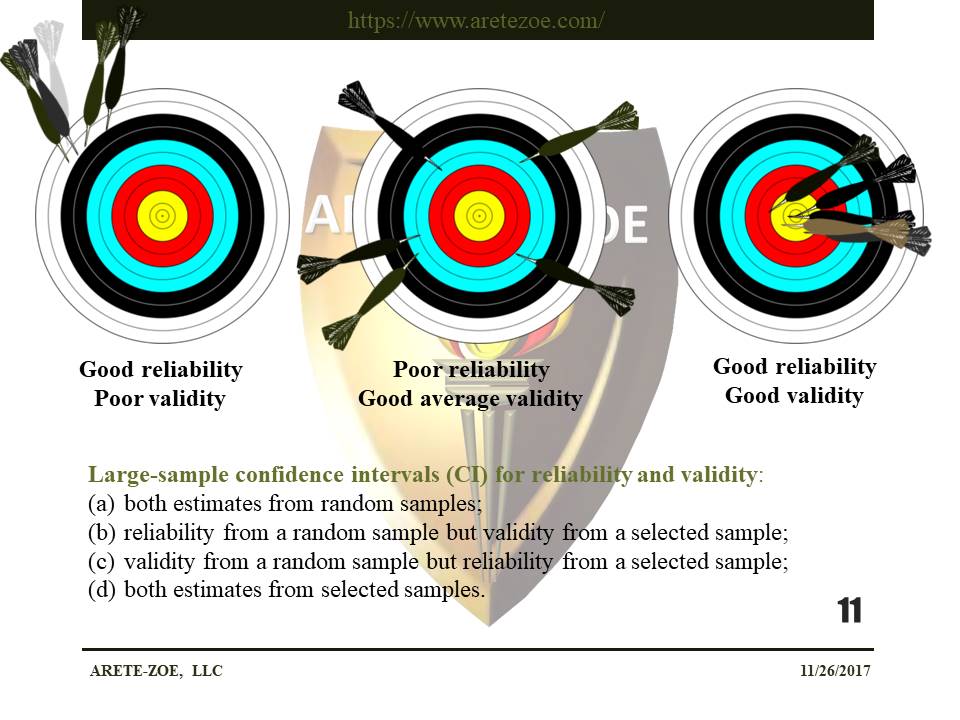

Confidence intervals on reliability, validity, or unattenuated validity are accurate as long as the selection ratio is at least 20%, and the selected sample size is 100 or larger. When the selection ratio is less than 20%, estimators tend to underestimate their parameters. A way how to achieve high reliability, validity, and confidence interval of safety information from post-authorization use is to utilize samples of real-world data that includes information on exposure. This monitoring technique is especially valuable in off-label uses and special populations. Mere collection of ICSRs without actual epidemiological evaluation using real-world data is not going to produce valid and reliable results.

Pharmacovigilance information collected through post-authorization surveillance systems is used to change drug labeling and update benefit: risk profile of marketed drugs. Physicians make clinical decisions based on this information. An accurate assessment is in the interest of all stakeholders in the system, from patients and physicians to manufacturers and insurers. Denial of a useful drug to a patient who may benefit from it is as harmful as prescribing it to a patient who is likely to develop an adverse effect. The system should, therefore, strive for greater accuracy and speed of detection of safety data to provide valid, reliable, and accurate information for benefit: risk assessment.

Pharmacovigilance information collected through post-authorization surveillance systems is used to change drug labeling and update benefit: risk profile of marketed drugs. Physicians make clinical decisions based on this information. Accurate information on the benefit: risk profile of medications is in the interest of all stakeholders in the system. Patients and physicians have as much interest in good-quality insight as manufacturers and insurers. Denial of a useful drug to a patient who may benefit from it is as harmful as prescribing it to a patient who is likely to develop an adverse effect. The system should, therefore, strive for greater accuracy and speed of detection of safety data to provide valid, reliable, and accurate information for benefit: risk assessment.

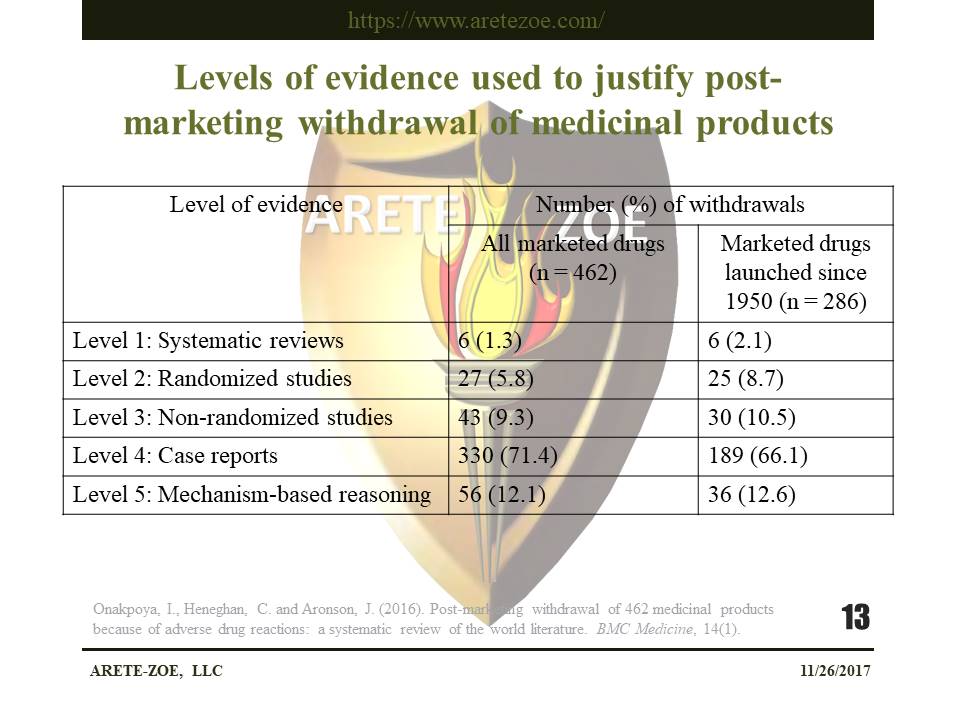

Between 1953 and 2013, 462 medicinal products were withdrawn from the EU market. The most common reason leading to withdrawal was hepatotoxicity. In more than 70% instances, the supporting evidence consisted of anecdotal reports. Only 43 (less than 10%) drugs were withdrawn worldwide, and 179 (39 %) were withdrawn in one country only. The median interval between the first reported adverse reaction and the year of first withdrawal was six years. The interval between first detection and authorization withdrawal did not significantly shorten since 1953.

Nancy Leveson, in her analysis of VIOXX, identified stakeholders in the U.S. healthcare system and defined system hazards relating to the use of prescription drugs. The public is exposed to an unsafe drug in the following situations:

- if the drug is released with a label that does not correctly specify the conditions for its safe use,

- when an approved drug is found to be unsafe, and appropriate responses are not taken,

- or if patients are exposed to unacceptable risk during clinical trials.

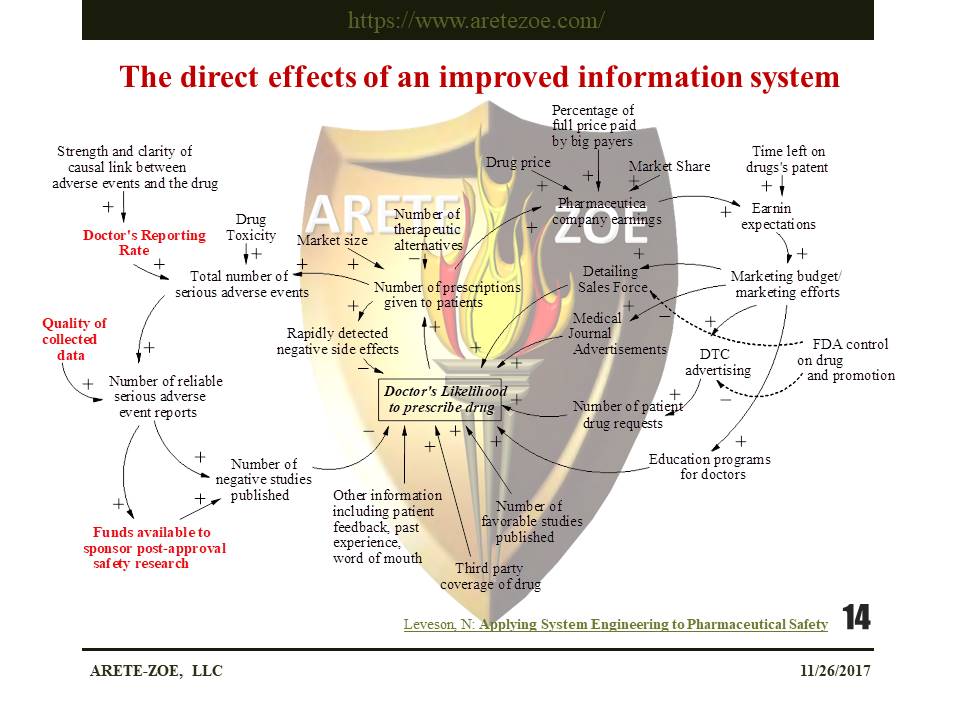

Unsafe use of drugs includes prescribing and dispensing errors, unsafe combinations, and patient non-compliance. The lack of effective treatment counts as a distinct system hazard. This situation occurs when an effective drug is not developed, approved or is withdrawn, is unaffordable, not accessible to physicians or patients, its introduction to the market is delayed, or when patients stop taking it because of intolerable side effects. Leveson, in her paper, advocates the introduction of additional controls and policy changes that would modify the information environment.

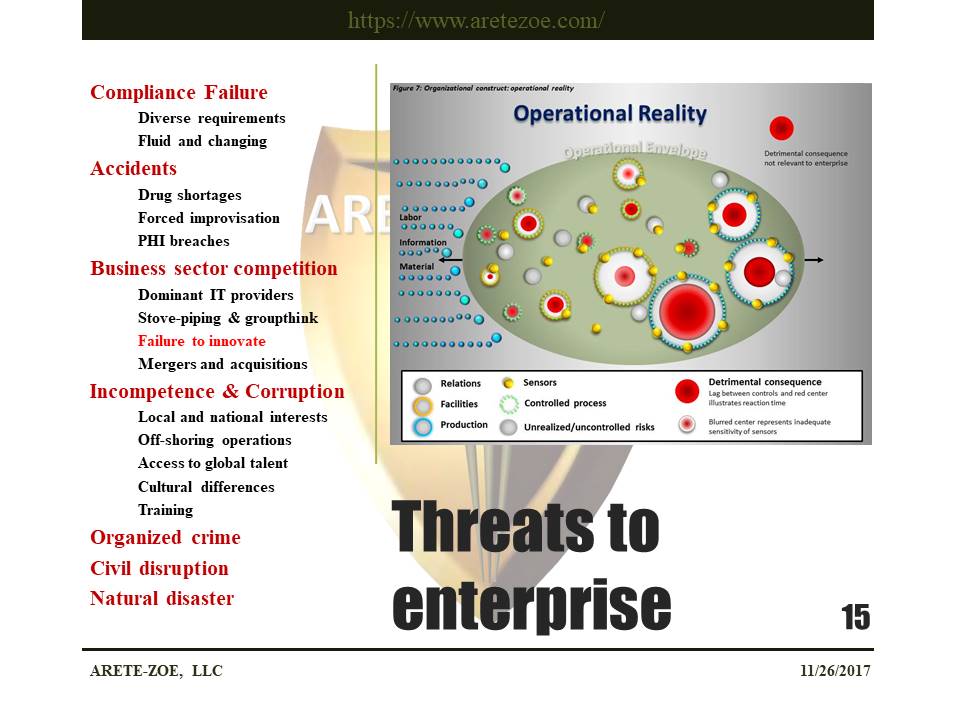

Compliance failure is not the only threat to the enterprise. The purpose of drug safety surveillance is to produce accurate and reliable information about drug benefit: risk profile to all stakeholders in the system who rely on such information, including patients and physicians. Shortages of prescription drugs, especially generics and sterile injectables in emergency medicine, may force clinicians to change treatment protocols to less familiar or less appropriate options. PHI breaches undermine patient and physician trust in hospital and clinical trial data management systems, potentially limiting their willingness to participate in clinical trials and consent to sharing their data for non-interventional studies. Dominant IT providers make it very difficult to take an innovative approach to data integration with other sources and new strategies to signal detection and evaluation. Mergers and acquisitions, stove-piping, and compartmentation of operations to protect intellectual property influence selection of staff for narrowly defined roles, stalling innovation even further.

Nařízení (EU) 2017/745 o zdravotnických prostředcích vstoupilo v platnost 26. května 2021. Platnost certifikátů vydaných podle stávajících směrnic vyprší nejpozději 24. května. Toto je třeba provést ve lhůtě, která odpovídá době nezbytné pro přezkoumání dokumentace a před vypršením platnosti současných certifikací. Česká republika stále nemá svůj oznámený subjekt. Jakmile dojde k akreditaci, bude ITC zavalen ohromným počtem nevyřízených podání v českém jazyce. Zajisdtěte si pomoc s podáním od týmu Arete-Zoe, který má s přípravou klinické dokumentace dle MDR bohaté zkušenosti.

The reduction of Czech-based Notified Bodies (NBs) leaves only one still pending accreditation and one in Slovakia that does accept submissions in Czech. The delay in accreditation has produced a significant backlog for submissions pending review and acceptance. The complexity of MDR is more stringent both for the preparers and the reviewers at the NB. This situation introduces many vulnerabilities into the submission process and represents substantial risk that can and should be minimized! The potential consequences of certification delays may be critical for some manufacturers. Is the cost penalty from delay because of necessary revision or rejection worth the minor economy of an in-house effort? Get your staff an assessment from a team with proven MDR success! Contact Arete-Zoe for a courtesy review of your situation and secure assistance that will reduce your risk! Stay agile, competitive, and profitable! What is the current situation? Regulation (EU) 2017/745 on medical devices (the Medical Device Regulation, MDR), which was adopted in April 2017, became applicable in the European Union on 26 May 2021, after a year delay due to Covid [i] . The certificates issued under the existing Directives for medical devices ( 93/42/EEC and 90/385/EEC ) will expire on or before May 24th, 2024. By then, all manufacturers who wish to keep their products on the market as medical devices, will have to upgrade their documents to the new standards. Previous documentation standards fall far short to the new requirements, placing significant burden on both the manufacturers and reviewers at the NB. Many previous submissions under MDR have been rejected based on documentation shortfalls within any of the many sections. When considered with the significant backlog, any aspect of documentation that requires revision only compounds certification delay and may jeopardize market access for many medical devices. All this needs to be done within a period that accounts for the time necessary for review prior to expiration of current certifications. Additionally, there is a significant bottleneck in submission processing due to the limited capacity of NBs in the EU due to a reduction in the number of designated NBs, increased number of products that are subject to review by NB due to reclassification, and increased complexity of MDR submissions compared to MDD/AIMD. The Czech Republic still does not have its own designated NB. Once accreditation occurs, the backlog of Czech language submissions will be overwhelming. The high number of returns and requests for amendments and revisions shall be expected in the initial months, slowing the process further for all. By May 2024, many manufacturers will find themselves in a situation when their products will no longer be marketable in the EU due to expired certificates and face additional consequences from having products purged from supply chain. Discussion MDR is here to stay. Czech Minister of Health MUDr. Vlastimil Válek in his introductory statement at the October 2022 AVDZP Conference [ii] stated that another postponement of MDR is out of question. While it is not in the interest of the European Union to be dominated by non-EU manufacturers, primarily from Asia, it is unlikely that the existing Regulation will be substantially changed to accommodate manufacturers’ concerns. Válek also reminded the public that the Wild East mentality with improvised devices throughout the hospital system that dominated the Czech market in the 1990s is gone and will not return. In short, MDR is a reality to which manufacturers will have to adjust. Notified bodies available to Czech manufacturers under MDR The number of EU NBs that are designated under MDR has increased to 34, half of which are located in Italy (9) and Germany (8). The remaining 17 are in Belgium (1), Croatia (1), Finland (2), France (1), Hungary (1), Ireland (1), the Netherlands (3), Norway (1), Poland (2), Slovakia (1), Slovenia (1), Spain (1) and Sweden (1) [iii] . European manufacturers can pursue certification of their products with any EU NB, with limitations to the type of product and the capacity and willingness of NBs to take on new clients. However, for access to the greatest number of NBs, the submission should be in English. Two Czech NBs were designated in Czechia under the 93/42/EEC (MDD): Institut pro testování a certifikaci, a.s. (ITC) and Elektrotechnický Zkušební Ústav, s.p. (EZÚ). Only one of them, ITC, is in the process for designation under MDR. However, the final scope of MDR codes ITC will be able to process has not been released. One additional institution, Czech Metrological Institute (CMI) is pursuing designation under MDR without prior history in medical devices under MDD or AIMD. The anticipated accreditation will take an additional year. Institut pro testování a certifikaci, a.s. (ITC), Czech Republic ITC’s current designations include Regulation (EU) 2016/425 Personal protective equipment, 2014/68/EU Pressure equipment, 2009/48/EC Safety of toys, Regulation (EU) No 305/2011 - Construction products and 2014/30/EU Electromagnetic compatibility. Designations under 93/42/EEC Medical devices and 98/79/EC In vitro diagnostic medical devices expired in May 2021 (MDD) and May 2022 (IVDD) [iv] . ITC will continue to perform audits under MDD during the transitional period until May 24, 2024. ITC submitted their application for designation under MDR on December 30, 2019. The Designating authority (ÚNMZ) verified completeness of the application and forwarded it to the European Commission in November 2020. The Commission designated the Joint Assessment Team in December 2020, which completed the evaluated in March 2021. On-site Joint Assessment was completed in June 2021. The official JAT report was issued in September 2021. ITC implemented CAPAs in fall 2021. In June 2022, designating authority ÚNMZ completed their review of CAPAs implemented by ITC and submitted it to the Joint Assessment Team for approval. In August 2022, ÚNMZ issued the final report. In September 2022, JAT issued its final assessment and a in October 23022, ITC underwent MDCG review and is now awaiting MDCG opinion that the notification can be accepted. The expectation is that ITC should be listed in the NANDO database by January 2023 for MDR [v] . According to Mgr. Jiří Heš, ITC will primarily serve Czech manufacturers who already are their clients and have certificates issued by them under MDD. New certificates under MDR won’t be issued in time and there will inevitably be a gap in coverage of products with valid MDD certification. [vi] ITC only began preparing application for designation under IVDR. Due to the extensive backlog of MDR certificates, it is reasonable to expect that the process of designation under IVDR will not be any faster. ITC currently does not offer any training on MDR for manufacturers or guidance on how to prepare submissions. The most significant thing any manufacturer can do for themselves is to ensure their submission is as appropriate as possible the first time. But they are left to their own means to sort out the transition from MDD to MDR. Without specific guidance from ITC on their expectations, there is significant risk from the ambiguity of the MDR Regulation itself. However, this risk can be reduced from experience from submissions under MDR to other NBs which will provide reasonable opportunity for a successful submission. Elektrotechnický Zkušební Ústav, s.p. (EZÚ), Czech Republic EZÚ’s current designations include Regulation (EU) No 305/2011 - Construction products and 2014/30/EU Electromagnetic compatibility. EZÚ won’t pursue designation under MDR. The activities EZÚ will continue include audit under MDD during the transitional period for 42 manufacturers whose certificates they serve, certification of quality management systems, and electrical safety. EZÚ also provides training on MDR for manufacturers and distributors [vii] . Czech Metrological Institute (CMI), Czech Republic CMI submitted their initial application in December 2020, a year later than ITC. The Joint Assessment Team evaluation (Article 39, paragraph 4 MDR) was completed in December 2021. In May 2022, CMI submitted their proposed CAPA plan. CMI strives to maintain the scope of devices included in their application (23 out of 44 basic codes and 18 out of 27 horizontal codes). The key requirement is to prove personnel availability for each code. CMI primarily intends to serve Czech manufacturers in Czech language, as only about a third of their reviewers have sufficient proficiency in English. CMI does not provide any training or guidance for manufacturers how to prepare documentation to pass their scrutiny. Certification of products on the Czech market There are over 400 Czech manufacturers listed in the database RZPRO holding nearly 6000 certificates that are currently valid. Of these, 4323 did not previously require the involvement of a NB (Class I). However, due to reclassification, some of these will require involvement of the NB under MDR, further stressing the throughput of the NB. Of the 1634 remaining certificates, 514 were issued by EZÚ and 391 by ITC. Another 133 MDD certificates were issued by other NBs that do not currently have MDR designation. The database also holds 2305 products other than Class I that do not have a NB listed. In total, ITC issued 541 certificates that are currently valid, including manufacturers from other countries. The database currently holds 630 valid certificates issued by EZÚ. All products certified by EZÚ will have to be recertified by another NB [viii] . The list of MDR codes that will be covered by ITC (or CMI, once designated) is not currently available. Mgr. Irena Storova (Czech State Institute for Drug Control) emphasized the quality of the MDR documentation as an essential condition required to avert a crisis. The current speed of issuing certificates by EU NBs is about 1.000 certificates a year. However, the anticipated need for medical devices in Europe is about 23.000 certificates issued by NBs over the period of 20 months, making the transition to MDR extremely challenging. The key problems are insufficient capacity of NB, partly due to accumulated backlog, partly due to increased complexity of MDR compared to MDD/AIMD, as well as inadequate preparedness of manufacturers to meet the new complex requirements of MDR [ix] . Experience of other EU NB shows exponential growth of applications and a serious lag in processing certificates. In February 2021, NBs received 1840 applications and processed 224 certificates. By October 2022, the number of applications grew to 8120, while the number of issued certificates was 1990 [x] . These numbers suggest further accumulation of backlog of unprocessed applications rather than catching up with the growing demand. The time to reach a Certificate according to MDR (MDR Quality Management System and Product certification) typically ranges from 13 to 18 months [xi] . This is consistent with ITC’s estimate that the review of a complete submission will take a year to issue a certificate. This means that all manufacturers who need their certificates renewed before the May 2024 deadline when they all expire will have to submit their applications before May 2023. Since ITC will only start accepting applications after the official MDR designation, it is safe to assume that all applications will be submitted in the period between the designation date and May 2023, creating a long backlog queue. To complicate the situation even further, manufacturers, whose MDR codes won’t be on ITC’s list, will have to look for a different NB to pursue their certificates. Czechia as a low price-point market The low-price level of devices on the Czech market complicates the transition to MDR even further. The system of defining reimbursements for medical devices is very rigid, and there are multiple pressures that keep prices down. These price controls conflict with increased costs associated with certification and recertification of products when considered with increased costs of energy, raw materials, transport, and labor. MUDr. Vlastimil Válek at the AVDZP Conference on October 13, 2022, stated that it is not in the interest of the European Union to allow non-EU manufacturers to dominate the EU market, and that there is an intrinsic value in self-sufficiency in times of crisis [xii] . The results from Survey on certifications and applications performed by MDCG & Stakeholders among NBs (51 NBs asked, 47 replies received) suggest that 60% of medical device clients are non-EU (10,913), compared to 7,143 EU clients [xiii] . Priority treatment for small business is not likely since SMEs are the majority of NB clients, both EU-wide and locally in the Czech Republic. In fact, as the threat for shortage of medical equipment becomes more urgent, policymakers might solve the crisis by prioritizing producers with high capacity, capable of meeting the demands of their respective health systems, as we have seen with the imports of medical equipment and protective materials during the Covid crisis. What is the risk to business due to delays in certification? The ability of NBs to process applications in a timely manner is an essential condition for the function of the medical device sector. This is directly influenced by the quality of manufacturers’ submission for certification. Manufacturers cannot legally keep their products on the EU market without valid certification. And, additional expenses will be incurred, if products have to be recovered from distribution chains due to delays in certification. Furthermore, this will create gaps in coverage, creating a void that can be filled by competitors. Extended periods of absence can stall otherwise good products and limit marketability once certification is finally obtained. Failure to obtain MDR certification for any portion of a product portfolio is an existential threat to any enterprise, potentially forcing reduction of staff, downsizing, making the enterprise vulnerable to competitors, or simply losing viability and going out of business. The absence of a feedback loop regarding the minutia of submissions’ content and format will cause additional delays and adjustments by the industry. ITC does not provide any MDR training and did not issue any guidance documents to facilitate successful submissions and reduce ambiguity relating to the novelty of the process. The first MDR certificate was issued in September 2019 by BSI [xiv] . This means that the cumulative experience in the industry among competition is significantly higher, placing Czech manufacturers 4 years behind other EU players. At present, Czech manufacturers have to rely on training provided by other NBs, industry consultants who rely on the same, in addition to feedback from their clients, and their own understanding of the Regulation and associated MDCG guidelines. Although CzechInvest does have a plan to start a comprehensive training program for manufacturers to facilitate the transition to MDR, the course has not started yet. The first students are expected to graduate in June 2024 [xv] . Learning curve by both newly designated NBs as well as manufacturers will inevitably affect the speed of processing, forcing reworks and amendments that would otherwise be avoidable. Securing consultancy with demonstrated MDR competency will remove substantial risk from the current situation. Recommendations What is the risk, and how does Arete-Zoe help your enterprise to mitigate such risk? The key to a successful MDR certification is a high quality, timely submission that complies with or better, exceeds minimum MDR requirements, ensuring timely processing and avoiding returns, requests for more information and outright rejections. It is important to note that the review and approval process depends on the understanding and application of MDR requirements by individual reviewers. Therefore, exceeding minimum requirements becomes a necessity for confident approval. The impact of additional information requests, although minor in terms of extra work, can be significant due to delays. Additionally, other manufacturers’ failed submissions in a long backlog of applications will continue to burden the system. The quality of the initial submission is essential to avoiding consequences in the transition to MDR and may be the single factor that keeps the business open. Manufacturers who have a fully trained in-house team already should still expect challenges in preparing MDR submissions themselves. The time to develop MDR expertise is very limited, considering the pressure to prepare the full documentation and submit it before May 2023. Even with a well-staffed team, the task can simply be overwhelming due to the sheer volume of material required in contrast to previous MDD/AIMD submissions. Arete-Zoe team has significant experience preparing clinical documentation for clients transitioning from MDD to MDR in both Czech and English and submissions through multiple NBs. Our exceptional success record with clinical documentation includes products that were previously rejected but passed with our assistance. We can help control the risk of failure or delay for our clients by providing the essential support you need to avert a avoidable delays in product certification. Arete-Zoe team can either prepare the full submission or augment your existing team with essential skillset your team might not have. References [i] https://www.ema.europa.eu/en/news/medical-device-regulation-comes-application [ii] Válek, V (2022). Introduction. AVDZP Conference 13/10/2022, Praha, Czech Republic. [iii] NANDO database https://ec.europa.eu/growth/tools-databases/nando/index.cfm?fuseaction=directive.notifiedbody&dir_id=34 [iv] NANDO database https://ec.europa.eu/growth/tools-databases/nando/index.cfm?fuseaction=directive.notifiedbody&dir_id=34 [v] Heš, J (2022). Implementace MDR: Kde jsme a kam směřujeme. AVDZP Conference 13/10/2022, Praha, Czech Republic. Institut pro Testování a Certifikaci. [vi] Heš, J (2022). Implementace MDR: Kde jsme a kam směřujeme. AVDZP Conference 13/10/2022, Praha, Czech Republic. Institut pro Testování a Certifikaci. [vii] Vlasák, M (2022). Dozorová činnost dle MDD. AVDZP Conference 13/10/2022, Praha, Czech Republic. Elektrotechnický zkušební ústav. [viii] Czech database of medical devices RZPRO https://eregpublicsecure.ksrzis.cz/Registr/RZPRO/ZdravotnickyProstredek [ix] Storova, I (2022). Problematika ukončení přechodného období MDR z pohledu SÚKL. AVDZP Conference 13/10/2022, Praha, Czech Republic. State Institute for Drug Control. [x] MDCG & Stakeholders (2022). Notified Bodies Survey on certyifications and applications (MDR/IVDR). 24/10/2022. European Commission. [xi] MDCG & Stakeholders (2022). Notified Bodies Survey on certyifications and applications (MDR/IVDR). 24/10/2022. European Commission. [xii] Válek, V (2022). Introduction. AVDZP Conference 13/10/2022, Praha, Czech Republic. [xiii] MDCG & Stakeholders (2022). Notified Bodies Survey on certifications and applications (MDR/IVDR). 24/10/2022. European Commission. https://health.ec.europa.eu/latest-updates/notified-bodies-survey-certifications-and-applications-2022-10-26_en?fbclid=IwAR3w3YH7UD2HBccQ6pBKWP3UlpgSnvQj9qFoNUeLIF-6ZWl8IOwP2Wx88Tk [xiv] BSI (2019). BSI certifies first product to the Medical Devices Regulation. 02 September 2019. BSI. https://www.bsigroup.com/en-GB/medical-devices/news-centre/enews/2019-news/bsi-certifies-first-product-to-the-medical-devices-regulation/ [xv] Hájek, J (2022). Národní plán obnovy. Komponenta 1. 4. Digitální ekonomika a společnost, inovativní start-upy a nové technologie. Program na podporu specifických systémových a produktových certifikací a souvisejícího vzdělávání. AVDZP Conference 13/10/2022, Praha, Czech Republic.

More than 500,000 medical technologies are available on the European market, from hospitals to community care settings and people's homes. The products range from syringes, pregnancy tests, and wheelchairs to X-Ray machines and body scanners, pacemakers, hip implants, and pharmacogenomic tests. The medical technology industry is the source of a constant flow of innovations. The sector spends about 8% of its sales on R&D. Typical product lifecycle is about 18 to 24 months when a new, improved version becomes available. In 2020, the European Patent Office (EPO) accepted nearly 14,200 patent applications in the medical technology sector, trumping pharmaceutical patents (8,500 applications) and biotechnology (7,200). European and U.S. entities filed almost 80% of the applications (38% EU and EEA, 39% U.S.) [ 1 ]. The European medical technology sector employs more than 760,000 people, mainly in Germany (210,000), the United Kingdom (102,800), Italy (94,000), France (89,000), Switzerland (63,000), and Ireland (40,000), accounting for 0.3% of total employment. In comparison, the European pharmaceutical industry employs around 795,000 people. These jobs reach a value-added of about €184,000 per employee. More than 33,000 medical technology exist in Europe, of which 95% qualify as small, medium, and micro-sized companies (SMEs). The majority of these enterprises employ less than 50 people [ 1 ]. In 2020, Europe had a positive trade balance in the medical technology sector of € 8.7 billion. Compared to 2019, the European trade balance dropped by 27.5% (€ 12 billion in 2019). The most important trading partners for Europe are the United States, China, Japan, and Mexico. Germany, Ireland, the Netherlands, Belgium, and Switzerland have the highest trade share, both within and outside the EU [ 2 ]. Until May 2021, the medical device sector was regulated by Medical Device and In Vitro Diagnostic Device Directives 93/42/EC and 90/385/EEC (MDD and IVDD), when the new Regulations replaced these: Medical Device Regulation (EU) 2017/745 (MDR) and In Vitro Diagnostic Device Regulation (IVDR) 2017/746 [ 3 ],[ 4 ]. The new regulations introduced numerous changes, including the reclassification of some devices, requiring additional obligations for manufacturers to comply with. About 85% of in-vitro diagnostic devices will now require Notified Body involvement, compared to ~20% under the IVDD. Existing MDD/IVDD certificates remain valid until May 2024. After this date, all devices on the EU market must comply with the new MDR/IVDR regulations [ 5 ]. For some manufacturers, the costs associated with keeping some of their devices on the market under MDR/IVDR may no longer justify the expense considering their profitability. Others may not be able to obtain new CE Mark certification in time due to decreased capacity of notified bodies. These factors combined are already reducing the number of devices on the EU market and limiting the certification of innovative products. The number of notified bodies available to review new certifications and recertifications dropped significantly under the MDR/IVDR. Of 51 notified bodies designated to MDD [ 6 ] and ten to AIMDD [ 7 ], only 29 obtained designation for MDR, of which seven operate in Germany, seven in Italy, and three in the Netherlands [ 8 ].

The Medical Device industry produces a vast number of products, ranging from bandages and surgical instruments to life function monitors to imaging technology. The technology currently in use varies from devices that have been in use for decades to highly innovative products. Innovations in the medical device field are frequent and typically incremental in response to feedback from physicians. Mordor Intelligence estimated the global Medical Devices market at USD 532.62 billion in 2021, growing at a CAGR of around 5.5%, to reach USD 734.39 billion in 2027 [1]. Fortune Business Insights projects the global medical devices market growth from $455.34 billion in 2021 to $657.98 billion in 2028 at a CAGR of 5.4%. This development follows a decline from 2020, when CAGR dropped to 3.7% due to the pandemic [2]. The key drivers of market growth include the rising prevalence of chronic diseases, increased disability throughout the population, technological advancements in medical devices, and population aging. The U.S. medical device market was valued at USD 186.5 billion in 2021 and is anticipated to exhibit a compound annual growth rate (CAGR) of 5.0% over the forecast period to reach USD 262.4 billion in 2028 [4]. The Medical Device sector is even larger than Biopharmaceuticals, that by comparison, employed over 224,000 people, earning $21.2 billion [3]. The rising prevalence of chronic diseases and the increasing geriatric population in the country are the key market drivers. The Medical Device industry has a significant impact on the U.S. economy and supports hundreds of thousands of jobs. More than 80 percent of U.S. medical device companies have fewer than 100 employees [5]. In 2020, the U.S. Medical Device industry supported over 329,000 jobs, with an annual payroll of $25.8 billion [3]. Employment and payroll for Medical Device Subsectors, 2020 ( SelectUSA ):

In the high consequence environment of pharmaceutical development, any assumption made earlier in the process can prove extremely costly if uncorrected once more information becomes available. From a business perspective, it is essential to create a safe avenue for communication of concerns regarding the drug candidate’s efficacy, safety, toxicity, or pharmacological function immediately as the researchers become aware of them.

Innovation always involves the risk of failure. It is an art to see what the data show, and what they don't, and which projections are the result of our wishful thinking or unsubstantiated assumptions. It may be just my impression that 14th-century logician William of Ockham whispers in my ear that entities shall not be multiplied unnecessarily.

Companies are growing in size due to acquisitions and mergers. Operations routinely span across geographical, jurisdictional, and cultural boundaries. The trend of industry consolidation continues in 2015 and 2016: the total number of deals flattened and remained even at around 600 mergers a year. Geographically, mergers, and acquisitions have been shifting from the U.S. to Western Europe. This shift is the result of transactions driven by the need to add complementary products to the core business areas and tax inversions.