All organizational dysfunctions track directly to leadership failings. (Part 2)

Ronald Sheckler • October 24, 2019

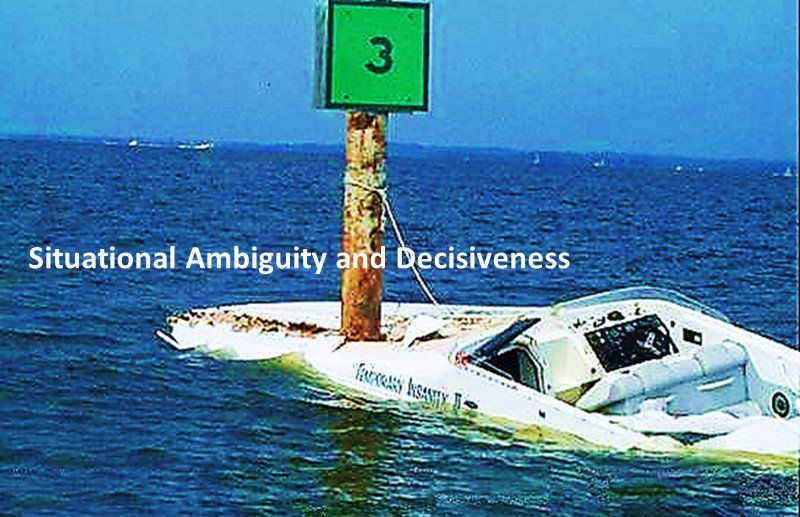

Situational Analysis: Ambiguous Threat and Operational Environment

Much has been written about the visceral similarities between war/conflict and business enterprise. The correlation is more than artful metaphor. We have Captains of Industry and military units identified as companies. Politics, commerce, and armed conflict are inextricably intertwined because they are societal manifestations of individual human nature and interpersonal relations. This may seem to stray from the topic but some philosophical introspection is important to set the context for discussion. Most attempts to transfer terms or process from one side to the other are often clumsy and ineffective. I will try to bridge some gaps from an “art of war” perspective, which derives from military campaign planning where complex operations are associated with immediate and severe consequences.

What ultimately determines success? Simplistically, some folks may quip, crossing the finish-line first and others, in our emoting, politically correct, self-esteem oriented times, may say, just crossing the finish-line is success. This is important because success is relative and in principal both are correct because success is accomplishing what you intended to do. However, are your aspirations feasible and is your ambition a vulnerability?

Ambiguity imposes risk, so how to proceed? Everyone constantly, and generally subconsciously, manages ambiguity. Individual experience and personality establish confidence and a personal comfort zone for accepting uncertainty. Audacity in some is offset by other’s hesitancy. Averseness generally comes from knowledge or perception of direct consequences or concern for unintended consequences and desire to avoid regret. Regardless, self-interests/preservation predisposes choice and although caution can lead to “analysis paralysis”, conversely, it takes a keen edge to separate daring from reckless.

We each introduce our individual perspectives into any group effort and attempt to imprint onto the collective demeanor. This alchemy of personality blending can be synchronous or dissonant. Acceptance of any proposition depends upon the effective organization of relevant information and reasoning used to persuade others that risk is manageable and consequences can be avoided or will be tolerable. So, how best to support that argument? Most importantly, once you gain consent, how do you maneuver through ambiguity to accomplish your goal while maintaining stakeholder confidence?

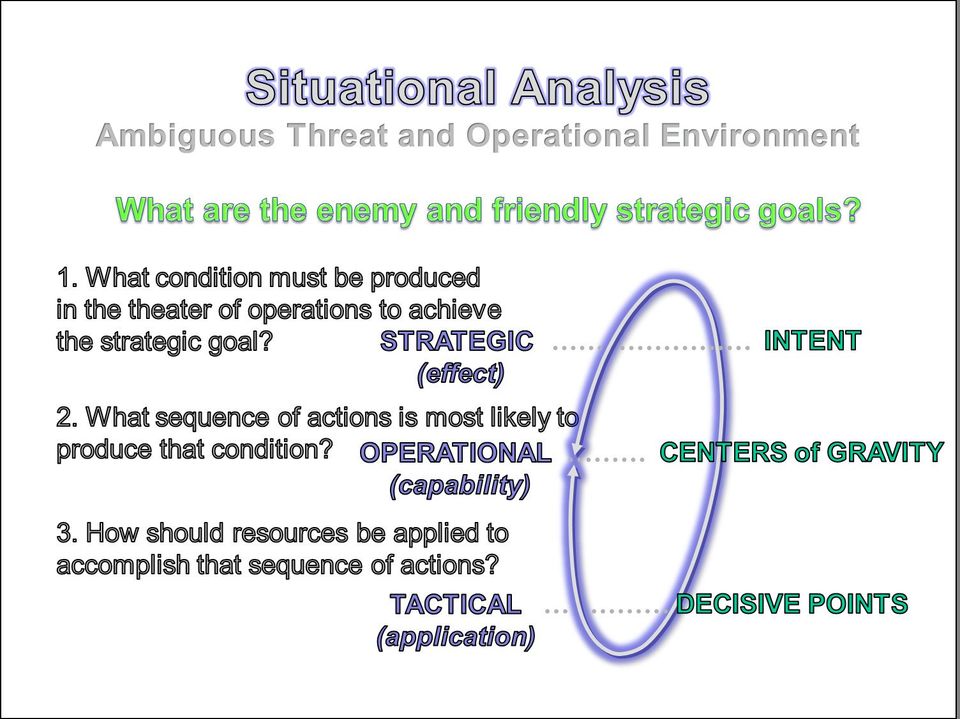

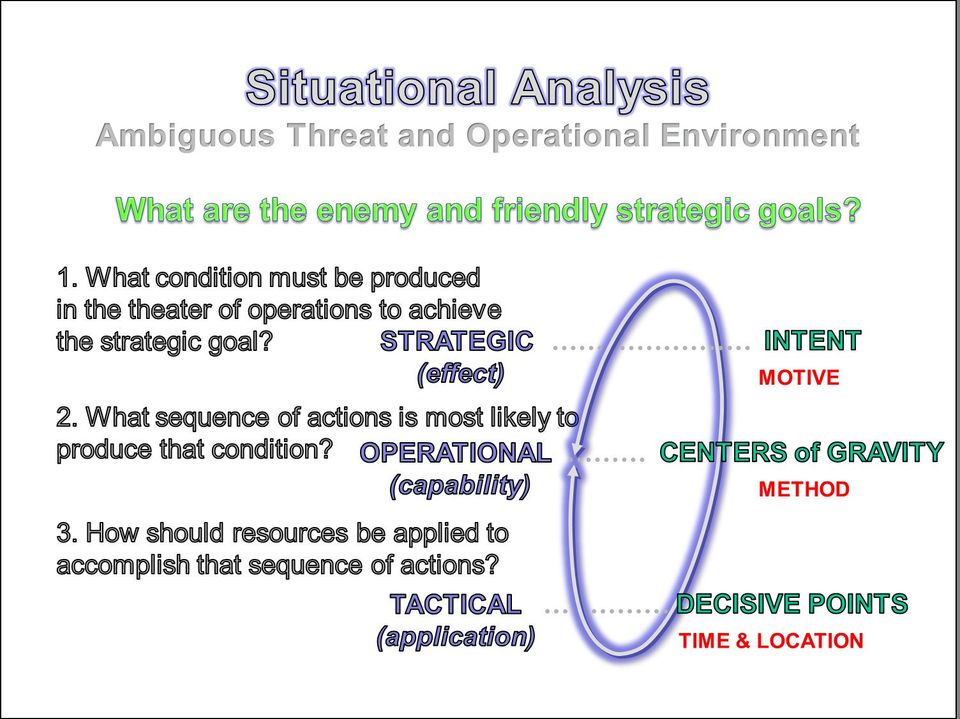

I suggest orienting on developing information collection and intelligence production that corresponds to the planning, decision, and execution activities within the enterprise life cycle. Information requirements supporting decision‐making are specific and change with the phase of evolution from concept, to creation, through growth, to sustainment. However, regardless of complexity or context there are three key questions that can be used to bring order to the most chaotic and ambiguous situations and will reduce risk by differentiating relevant from distraction.

Of course these three questions must relate to an accurate understanding of the strategic goal for friend and/or foe. Internally this may be a competently articulated mission statement or an unpublished but commonly acknowledged intent. When used to correlate with a competitor, specific information collection must corroborate published positions or intelligence should be used as the basis to redefine it. This provides clarity of purpose and intent that all associated activities can align with and enables effective sifting through the datascape of any situation to visualize the essential scope and sequence of operational development, also revealing where critical risk may exist.

Used as a template, it adds value to either macro analysis or micro scrutiny correlating to the strategic goal/terminal objective/end-state of a proposed campaign i.e. increased market share, new product acceptance, expanded operational area, merger/acquisition, amicable separation, or regime change. Likewise, when applied to a competitor or adversary it can be used to aid predictive analysis because subconsciously humans process information in the same way, but thankfully with a wide range of effectiveness. There may be nurtured differences between individuals or groups because of industry or social culture and experiential influences, however the reasoning process or nature, remains the same. It is important to assess individual influence before making a conclusion or prediction about collective persona.

Regardless if it is a start-up or a new initiative in a mature enterprise, it all starts with what seems to be a good idea, which must be converted into a feasible proposition that can be successfully executed. This must begin by formulating a mission statement inclusive of purpose, method, and end-state. Once you have Who, What, When, Where, and Why, the concept of operation or How becomes more intuitively obvious.

Although any plan must proceed on assumptions, it is essential to develop an information collection plan that replaces assumptions with facts and monitors for situational changes that will affect planning conclusions. These are indicators of consequence and potential risks should be tracked with Priority Information Requirements (PIR). PIR may be further emphasized for correlation with essential decision points by leadership as Critical Information Requirements (CIR). CIR focuses information collection and differentiates actionable PIR from trivial pursuit and statistical aggregation that often distracts Competitive Intelligence (CI) schemes. CIR validates operational planning assumptions and indicates a prudent adjustment to intentions, timing, or reallocation of resources relative to the strategic goal. Also, restraint is imperative so that assumptions are minimized to only what is essential to move the concept forward and protect vulnerabilities.

As answers/data for these questions populate, it will become obvious where there are shortfalls and what essential resources or capability must be acquired, spawning nested actions and supporting plans, essential to overall feasibility. These tangential requirements are developed into planning branches and sequels that must be confidently completed to meet intermediate, conditional milestones. This incremental approach avoids consequence from over commitment of resources by matching investment and effort to ongoing feasibility determinations. Additionally, this process enhances operational agility by providing proactive recognition to circumvent or mitigate emerging technical or political obstacles. Natural compartmentation and parallel planning opportunities from branches, provides intrinsic security potential when managed intentionally; otherwise it represents a significant vulnerability that will compromise the outcome from accidental disclosures or easy exploitation. This systems perspective is critical and why an optimal safety and security profile should not fixate on monitoring people, places, or things but be designed to preserve essential functions and sensitive information critical to enterprise viability, which, of course, is comprised of people, places, and things. The subtle shift in rhyme and reason is significant.

Effective decision-support requires accurate information and competent analysis that values multi-source corroboration and understands that annual reports are, to a certain extent, marketing propaganda and may not reveal all significant intentions. Convenient information should be suspect as should CI vendor products. Once there is confidence for understanding of the Strategic Goal, the remainder falls into place with the three key questions.

These questions merge perspective for what is often segregated as strategic, operational, or tactical. This facilitates a concise introspection deriving an essential scope and direction for operational development and intuitively identifies where safeguards should be emplaced.

When extended, these three questions accommodate a broad range of analysis and planning approaches and terminologies. The most important observation is that where some organizations differentiate planning teams by Strategic or Tactical orientation, it is essential that each focus group understands its relationship to others and the overall strategic goal so that within their respective spheres of responsibility, operations can be paced to complement the system as a whole i.e. if a regional transportation slowdown is expected, can stockpiles be created by a temporary production surge to keep assembly rates at the requisite level to satisfy contract terms or can redundant transportation arrangements be made? If political obstacles are anticipated at a specific port of entry, what alternate routing options can be arranged? If a key contractor is lost to merger/buyout by a competitor what arrangement will reduce the impact? What affect will product diversion or counterfeiting have on timelines and relationships?

Planning dynamics are fairly unique within the scope of each question. However, associated operating locations will be engaged in a myriad of local routines, which could, accidentally or intentionally, adversely affect throughput and subsequently disrupt the whole system. Holistic, vulnerability assessment is imperative.

When applying these questions for predictive analysis of potential illicit threats, evaluation of their public rhetoric or past actions will provide a reasonable assessment of their strategic goal. Differentiating but processing threats, across the spectrum, in a similar manner will enable a comprehensive correlation of probable actions against system vulnerabilities so that countermeasures can be justified and implemented.

It takes a keen edge to separate daring from reckless and three key questions to manage the significant risk that ambiguity represents. This is the initial entry point for application of mature processes of intelligence and operational planning created, refined, and proven in the high threat ambiguities of war, which are relevant to business and competitive intelligence. Embrace daring, resist reckless, Business is war!

Nařízení (EU) 2017/745 o zdravotnických prostředcích vstoupilo v platnost 26. května 2021. Platnost certifikátů vydaných podle stávajících směrnic vyprší nejpozději 24. května. Toto je třeba provést ve lhůtě, která odpovídá době nezbytné pro přezkoumání dokumentace a před vypršením platnosti současných certifikací. Česká republika stále nemá svůj oznámený subjekt. Jakmile dojde k akreditaci, bude ITC zavalen ohromným počtem nevyřízených podání v českém jazyce. Zajisdtěte si pomoc s podáním od týmu Arete-Zoe, který má s přípravou klinické dokumentace dle MDR bohaté zkušenosti.

The reduction of Czech-based Notified Bodies (NBs) leaves only one still pending accreditation and one in Slovakia that does accept submissions in Czech. The delay in accreditation has produced a significant backlog for submissions pending review and acceptance. The complexity of MDR is more stringent both for the preparers and the reviewers at the NB. This situation introduces many vulnerabilities into the submission process and represents substantial risk that can and should be minimized! The potential consequences of certification delays may be critical for some manufacturers. Is the cost penalty from delay because of necessary revision or rejection worth the minor economy of an in-house effort? Get your staff an assessment from a team with proven MDR success! Contact Arete-Zoe for a courtesy review of your situation and secure assistance that will reduce your risk! Stay agile, competitive, and profitable! What is the current situation? Regulation (EU) 2017/745 on medical devices (the Medical Device Regulation, MDR), which was adopted in April 2017, became applicable in the European Union on 26 May 2021, after a year delay due to Covid [i] . The certificates issued under the existing Directives for medical devices ( 93/42/EEC and 90/385/EEC ) will expire on or before May 24th, 2024. By then, all manufacturers who wish to keep their products on the market as medical devices, will have to upgrade their documents to the new standards. Previous documentation standards fall far short to the new requirements, placing significant burden on both the manufacturers and reviewers at the NB. Many previous submissions under MDR have been rejected based on documentation shortfalls within any of the many sections. When considered with the significant backlog, any aspect of documentation that requires revision only compounds certification delay and may jeopardize market access for many medical devices. All this needs to be done within a period that accounts for the time necessary for review prior to expiration of current certifications. Additionally, there is a significant bottleneck in submission processing due to the limited capacity of NBs in the EU due to a reduction in the number of designated NBs, increased number of products that are subject to review by NB due to reclassification, and increased complexity of MDR submissions compared to MDD/AIMD. The Czech Republic still does not have its own designated NB. Once accreditation occurs, the backlog of Czech language submissions will be overwhelming. The high number of returns and requests for amendments and revisions shall be expected in the initial months, slowing the process further for all. By May 2024, many manufacturers will find themselves in a situation when their products will no longer be marketable in the EU due to expired certificates and face additional consequences from having products purged from supply chain. Discussion MDR is here to stay. Czech Minister of Health MUDr. Vlastimil Válek in his introductory statement at the October 2022 AVDZP Conference [ii] stated that another postponement of MDR is out of question. While it is not in the interest of the European Union to be dominated by non-EU manufacturers, primarily from Asia, it is unlikely that the existing Regulation will be substantially changed to accommodate manufacturers’ concerns. Válek also reminded the public that the Wild East mentality with improvised devices throughout the hospital system that dominated the Czech market in the 1990s is gone and will not return. In short, MDR is a reality to which manufacturers will have to adjust. Notified bodies available to Czech manufacturers under MDR The number of EU NBs that are designated under MDR has increased to 34, half of which are located in Italy (9) and Germany (8). The remaining 17 are in Belgium (1), Croatia (1), Finland (2), France (1), Hungary (1), Ireland (1), the Netherlands (3), Norway (1), Poland (2), Slovakia (1), Slovenia (1), Spain (1) and Sweden (1) [iii] . European manufacturers can pursue certification of their products with any EU NB, with limitations to the type of product and the capacity and willingness of NBs to take on new clients. However, for access to the greatest number of NBs, the submission should be in English. Two Czech NBs were designated in Czechia under the 93/42/EEC (MDD): Institut pro testování a certifikaci, a.s. (ITC) and Elektrotechnický Zkušební Ústav, s.p. (EZÚ). Only one of them, ITC, is in the process for designation under MDR. However, the final scope of MDR codes ITC will be able to process has not been released. One additional institution, Czech Metrological Institute (CMI) is pursuing designation under MDR without prior history in medical devices under MDD or AIMD. The anticipated accreditation will take an additional year. Institut pro testování a certifikaci, a.s. (ITC), Czech Republic ITC’s current designations include Regulation (EU) 2016/425 Personal protective equipment, 2014/68/EU Pressure equipment, 2009/48/EC Safety of toys, Regulation (EU) No 305/2011 - Construction products and 2014/30/EU Electromagnetic compatibility. Designations under 93/42/EEC Medical devices and 98/79/EC In vitro diagnostic medical devices expired in May 2021 (MDD) and May 2022 (IVDD) [iv] . ITC will continue to perform audits under MDD during the transitional period until May 24, 2024. ITC submitted their application for designation under MDR on December 30, 2019. The Designating authority (ÚNMZ) verified completeness of the application and forwarded it to the European Commission in November 2020. The Commission designated the Joint Assessment Team in December 2020, which completed the evaluated in March 2021. On-site Joint Assessment was completed in June 2021. The official JAT report was issued in September 2021. ITC implemented CAPAs in fall 2021. In June 2022, designating authority ÚNMZ completed their review of CAPAs implemented by ITC and submitted it to the Joint Assessment Team for approval. In August 2022, ÚNMZ issued the final report. In September 2022, JAT issued its final assessment and a in October 23022, ITC underwent MDCG review and is now awaiting MDCG opinion that the notification can be accepted. The expectation is that ITC should be listed in the NANDO database by January 2023 for MDR [v] . According to Mgr. Jiří Heš, ITC will primarily serve Czech manufacturers who already are their clients and have certificates issued by them under MDD. New certificates under MDR won’t be issued in time and there will inevitably be a gap in coverage of products with valid MDD certification. [vi] ITC only began preparing application for designation under IVDR. Due to the extensive backlog of MDR certificates, it is reasonable to expect that the process of designation under IVDR will not be any faster. ITC currently does not offer any training on MDR for manufacturers or guidance on how to prepare submissions. The most significant thing any manufacturer can do for themselves is to ensure their submission is as appropriate as possible the first time. But they are left to their own means to sort out the transition from MDD to MDR. Without specific guidance from ITC on their expectations, there is significant risk from the ambiguity of the MDR Regulation itself. However, this risk can be reduced from experience from submissions under MDR to other NBs which will provide reasonable opportunity for a successful submission. Elektrotechnický Zkušební Ústav, s.p. (EZÚ), Czech Republic EZÚ’s current designations include Regulation (EU) No 305/2011 - Construction products and 2014/30/EU Electromagnetic compatibility. EZÚ won’t pursue designation under MDR. The activities EZÚ will continue include audit under MDD during the transitional period for 42 manufacturers whose certificates they serve, certification of quality management systems, and electrical safety. EZÚ also provides training on MDR for manufacturers and distributors [vii] . Czech Metrological Institute (CMI), Czech Republic CMI submitted their initial application in December 2020, a year later than ITC. The Joint Assessment Team evaluation (Article 39, paragraph 4 MDR) was completed in December 2021. In May 2022, CMI submitted their proposed CAPA plan. CMI strives to maintain the scope of devices included in their application (23 out of 44 basic codes and 18 out of 27 horizontal codes). The key requirement is to prove personnel availability for each code. CMI primarily intends to serve Czech manufacturers in Czech language, as only about a third of their reviewers have sufficient proficiency in English. CMI does not provide any training or guidance for manufacturers how to prepare documentation to pass their scrutiny. Certification of products on the Czech market There are over 400 Czech manufacturers listed in the database RZPRO holding nearly 6000 certificates that are currently valid. Of these, 4323 did not previously require the involvement of a NB (Class I). However, due to reclassification, some of these will require involvement of the NB under MDR, further stressing the throughput of the NB. Of the 1634 remaining certificates, 514 were issued by EZÚ and 391 by ITC. Another 133 MDD certificates were issued by other NBs that do not currently have MDR designation. The database also holds 2305 products other than Class I that do not have a NB listed. In total, ITC issued 541 certificates that are currently valid, including manufacturers from other countries. The database currently holds 630 valid certificates issued by EZÚ. All products certified by EZÚ will have to be recertified by another NB [viii] . The list of MDR codes that will be covered by ITC (or CMI, once designated) is not currently available. Mgr. Irena Storova (Czech State Institute for Drug Control) emphasized the quality of the MDR documentation as an essential condition required to avert a crisis. The current speed of issuing certificates by EU NBs is about 1.000 certificates a year. However, the anticipated need for medical devices in Europe is about 23.000 certificates issued by NBs over the period of 20 months, making the transition to MDR extremely challenging. The key problems are insufficient capacity of NB, partly due to accumulated backlog, partly due to increased complexity of MDR compared to MDD/AIMD, as well as inadequate preparedness of manufacturers to meet the new complex requirements of MDR [ix] . Experience of other EU NB shows exponential growth of applications and a serious lag in processing certificates. In February 2021, NBs received 1840 applications and processed 224 certificates. By October 2022, the number of applications grew to 8120, while the number of issued certificates was 1990 [x] . These numbers suggest further accumulation of backlog of unprocessed applications rather than catching up with the growing demand. The time to reach a Certificate according to MDR (MDR Quality Management System and Product certification) typically ranges from 13 to 18 months [xi] . This is consistent with ITC’s estimate that the review of a complete submission will take a year to issue a certificate. This means that all manufacturers who need their certificates renewed before the May 2024 deadline when they all expire will have to submit their applications before May 2023. Since ITC will only start accepting applications after the official MDR designation, it is safe to assume that all applications will be submitted in the period between the designation date and May 2023, creating a long backlog queue. To complicate the situation even further, manufacturers, whose MDR codes won’t be on ITC’s list, will have to look for a different NB to pursue their certificates. Czechia as a low price-point market The low-price level of devices on the Czech market complicates the transition to MDR even further. The system of defining reimbursements for medical devices is very rigid, and there are multiple pressures that keep prices down. These price controls conflict with increased costs associated with certification and recertification of products when considered with increased costs of energy, raw materials, transport, and labor. MUDr. Vlastimil Válek at the AVDZP Conference on October 13, 2022, stated that it is not in the interest of the European Union to allow non-EU manufacturers to dominate the EU market, and that there is an intrinsic value in self-sufficiency in times of crisis [xii] . The results from Survey on certifications and applications performed by MDCG & Stakeholders among NBs (51 NBs asked, 47 replies received) suggest that 60% of medical device clients are non-EU (10,913), compared to 7,143 EU clients [xiii] . Priority treatment for small business is not likely since SMEs are the majority of NB clients, both EU-wide and locally in the Czech Republic. In fact, as the threat for shortage of medical equipment becomes more urgent, policymakers might solve the crisis by prioritizing producers with high capacity, capable of meeting the demands of their respective health systems, as we have seen with the imports of medical equipment and protective materials during the Covid crisis. What is the risk to business due to delays in certification? The ability of NBs to process applications in a timely manner is an essential condition for the function of the medical device sector. This is directly influenced by the quality of manufacturers’ submission for certification. Manufacturers cannot legally keep their products on the EU market without valid certification. And, additional expenses will be incurred, if products have to be recovered from distribution chains due to delays in certification. Furthermore, this will create gaps in coverage, creating a void that can be filled by competitors. Extended periods of absence can stall otherwise good products and limit marketability once certification is finally obtained. Failure to obtain MDR certification for any portion of a product portfolio is an existential threat to any enterprise, potentially forcing reduction of staff, downsizing, making the enterprise vulnerable to competitors, or simply losing viability and going out of business. The absence of a feedback loop regarding the minutia of submissions’ content and format will cause additional delays and adjustments by the industry. ITC does not provide any MDR training and did not issue any guidance documents to facilitate successful submissions and reduce ambiguity relating to the novelty of the process. The first MDR certificate was issued in September 2019 by BSI [xiv] . This means that the cumulative experience in the industry among competition is significantly higher, placing Czech manufacturers 4 years behind other EU players. At present, Czech manufacturers have to rely on training provided by other NBs, industry consultants who rely on the same, in addition to feedback from their clients, and their own understanding of the Regulation and associated MDCG guidelines. Although CzechInvest does have a plan to start a comprehensive training program for manufacturers to facilitate the transition to MDR, the course has not started yet. The first students are expected to graduate in June 2024 [xv] . Learning curve by both newly designated NBs as well as manufacturers will inevitably affect the speed of processing, forcing reworks and amendments that would otherwise be avoidable. Securing consultancy with demonstrated MDR competency will remove substantial risk from the current situation. Recommendations What is the risk, and how does Arete-Zoe help your enterprise to mitigate such risk? The key to a successful MDR certification is a high quality, timely submission that complies with or better, exceeds minimum MDR requirements, ensuring timely processing and avoiding returns, requests for more information and outright rejections. It is important to note that the review and approval process depends on the understanding and application of MDR requirements by individual reviewers. Therefore, exceeding minimum requirements becomes a necessity for confident approval. The impact of additional information requests, although minor in terms of extra work, can be significant due to delays. Additionally, other manufacturers’ failed submissions in a long backlog of applications will continue to burden the system. The quality of the initial submission is essential to avoiding consequences in the transition to MDR and may be the single factor that keeps the business open. Manufacturers who have a fully trained in-house team already should still expect challenges in preparing MDR submissions themselves. The time to develop MDR expertise is very limited, considering the pressure to prepare the full documentation and submit it before May 2023. Even with a well-staffed team, the task can simply be overwhelming due to the sheer volume of material required in contrast to previous MDD/AIMD submissions. Arete-Zoe team has significant experience preparing clinical documentation for clients transitioning from MDD to MDR in both Czech and English and submissions through multiple NBs. Our exceptional success record with clinical documentation includes products that were previously rejected but passed with our assistance. We can help control the risk of failure or delay for our clients by providing the essential support you need to avert a avoidable delays in product certification. Arete-Zoe team can either prepare the full submission or augment your existing team with essential skillset your team might not have. References [i] https://www.ema.europa.eu/en/news/medical-device-regulation-comes-application [ii] Válek, V (2022). Introduction. AVDZP Conference 13/10/2022, Praha, Czech Republic. [iii] NANDO database https://ec.europa.eu/growth/tools-databases/nando/index.cfm?fuseaction=directive.notifiedbody&dir_id=34 [iv] NANDO database https://ec.europa.eu/growth/tools-databases/nando/index.cfm?fuseaction=directive.notifiedbody&dir_id=34 [v] Heš, J (2022). Implementace MDR: Kde jsme a kam směřujeme. AVDZP Conference 13/10/2022, Praha, Czech Republic. Institut pro Testování a Certifikaci. [vi] Heš, J (2022). Implementace MDR: Kde jsme a kam směřujeme. AVDZP Conference 13/10/2022, Praha, Czech Republic. Institut pro Testování a Certifikaci. [vii] Vlasák, M (2022). Dozorová činnost dle MDD. AVDZP Conference 13/10/2022, Praha, Czech Republic. Elektrotechnický zkušební ústav. [viii] Czech database of medical devices RZPRO https://eregpublicsecure.ksrzis.cz/Registr/RZPRO/ZdravotnickyProstredek [ix] Storova, I (2022). Problematika ukončení přechodného období MDR z pohledu SÚKL. AVDZP Conference 13/10/2022, Praha, Czech Republic. State Institute for Drug Control. [x] MDCG & Stakeholders (2022). Notified Bodies Survey on certyifications and applications (MDR/IVDR). 24/10/2022. European Commission. [xi] MDCG & Stakeholders (2022). Notified Bodies Survey on certyifications and applications (MDR/IVDR). 24/10/2022. European Commission. [xii] Válek, V (2022). Introduction. AVDZP Conference 13/10/2022, Praha, Czech Republic. [xiii] MDCG & Stakeholders (2022). Notified Bodies Survey on certifications and applications (MDR/IVDR). 24/10/2022. European Commission. https://health.ec.europa.eu/latest-updates/notified-bodies-survey-certifications-and-applications-2022-10-26_en?fbclid=IwAR3w3YH7UD2HBccQ6pBKWP3UlpgSnvQj9qFoNUeLIF-6ZWl8IOwP2Wx88Tk [xiv] BSI (2019). BSI certifies first product to the Medical Devices Regulation. 02 September 2019. BSI. https://www.bsigroup.com/en-GB/medical-devices/news-centre/enews/2019-news/bsi-certifies-first-product-to-the-medical-devices-regulation/ [xv] Hájek, J (2022). Národní plán obnovy. Komponenta 1. 4. Digitální ekonomika a společnost, inovativní start-upy a nové technologie. Program na podporu specifických systémových a produktových certifikací a souvisejícího vzdělávání. AVDZP Conference 13/10/2022, Praha, Czech Republic.

More than 500,000 medical technologies are available on the European market, from hospitals to community care settings and people's homes. The products range from syringes, pregnancy tests, and wheelchairs to X-Ray machines and body scanners, pacemakers, hip implants, and pharmacogenomic tests. The medical technology industry is the source of a constant flow of innovations. The sector spends about 8% of its sales on R&D. Typical product lifecycle is about 18 to 24 months when a new, improved version becomes available. In 2020, the European Patent Office (EPO) accepted nearly 14,200 patent applications in the medical technology sector, trumping pharmaceutical patents (8,500 applications) and biotechnology (7,200). European and U.S. entities filed almost 80% of the applications (38% EU and EEA, 39% U.S.) [ 1 ]. The European medical technology sector employs more than 760,000 people, mainly in Germany (210,000), the United Kingdom (102,800), Italy (94,000), France (89,000), Switzerland (63,000), and Ireland (40,000), accounting for 0.3% of total employment. In comparison, the European pharmaceutical industry employs around 795,000 people. These jobs reach a value-added of about €184,000 per employee. More than 33,000 medical technology exist in Europe, of which 95% qualify as small, medium, and micro-sized companies (SMEs). The majority of these enterprises employ less than 50 people [ 1 ]. In 2020, Europe had a positive trade balance in the medical technology sector of € 8.7 billion. Compared to 2019, the European trade balance dropped by 27.5% (€ 12 billion in 2019). The most important trading partners for Europe are the United States, China, Japan, and Mexico. Germany, Ireland, the Netherlands, Belgium, and Switzerland have the highest trade share, both within and outside the EU [ 2 ]. Until May 2021, the medical device sector was regulated by Medical Device and In Vitro Diagnostic Device Directives 93/42/EC and 90/385/EEC (MDD and IVDD), when the new Regulations replaced these: Medical Device Regulation (EU) 2017/745 (MDR) and In Vitro Diagnostic Device Regulation (IVDR) 2017/746 [ 3 ],[ 4 ]. The new regulations introduced numerous changes, including the reclassification of some devices, requiring additional obligations for manufacturers to comply with. About 85% of in-vitro diagnostic devices will now require Notified Body involvement, compared to ~20% under the IVDD. Existing MDD/IVDD certificates remain valid until May 2024. After this date, all devices on the EU market must comply with the new MDR/IVDR regulations [ 5 ]. For some manufacturers, the costs associated with keeping some of their devices on the market under MDR/IVDR may no longer justify the expense considering their profitability. Others may not be able to obtain new CE Mark certification in time due to decreased capacity of notified bodies. These factors combined are already reducing the number of devices on the EU market and limiting the certification of innovative products. The number of notified bodies available to review new certifications and recertifications dropped significantly under the MDR/IVDR. Of 51 notified bodies designated to MDD [ 6 ] and ten to AIMDD [ 7 ], only 29 obtained designation for MDR, of which seven operate in Germany, seven in Italy, and three in the Netherlands [ 8 ].

The Medical Device industry produces a vast number of products, ranging from bandages and surgical instruments to life function monitors to imaging technology. The technology currently in use varies from devices that have been in use for decades to highly innovative products. Innovations in the medical device field are frequent and typically incremental in response to feedback from physicians. Mordor Intelligence estimated the global Medical Devices market at USD 532.62 billion in 2021, growing at a CAGR of around 5.5%, to reach USD 734.39 billion in 2027 [1]. Fortune Business Insights projects the global medical devices market growth from $455.34 billion in 2021 to $657.98 billion in 2028 at a CAGR of 5.4%. This development follows a decline from 2020, when CAGR dropped to 3.7% due to the pandemic [2]. The key drivers of market growth include the rising prevalence of chronic diseases, increased disability throughout the population, technological advancements in medical devices, and population aging. The U.S. medical device market was valued at USD 186.5 billion in 2021 and is anticipated to exhibit a compound annual growth rate (CAGR) of 5.0% over the forecast period to reach USD 262.4 billion in 2028 [4]. The Medical Device sector is even larger than Biopharmaceuticals, that by comparison, employed over 224,000 people, earning $21.2 billion [3]. The rising prevalence of chronic diseases and the increasing geriatric population in the country are the key market drivers. The Medical Device industry has a significant impact on the U.S. economy and supports hundreds of thousands of jobs. More than 80 percent of U.S. medical device companies have fewer than 100 employees [5]. In 2020, the U.S. Medical Device industry supported over 329,000 jobs, with an annual payroll of $25.8 billion [3]. Employment and payroll for Medical Device Subsectors, 2020 ( SelectUSA ):

In the high consequence environment of pharmaceutical development, any assumption made earlier in the process can prove extremely costly if uncorrected once more information becomes available. From a business perspective, it is essential to create a safe avenue for communication of concerns regarding the drug candidate’s efficacy, safety, toxicity, or pharmacological function immediately as the researchers become aware of them.

Innovation always involves the risk of failure. It is an art to see what the data show, and what they don't, and which projections are the result of our wishful thinking or unsubstantiated assumptions. It may be just my impression that 14th-century logician William of Ockham whispers in my ear that entities shall not be multiplied unnecessarily.

Companies are growing in size due to acquisitions and mergers. Operations routinely span across geographical, jurisdictional, and cultural boundaries. The trend of industry consolidation continues in 2015 and 2016: the total number of deals flattened and remained even at around 600 mergers a year. Geographically, mergers, and acquisitions have been shifting from the U.S. to Western Europe. This shift is the result of transactions driven by the need to add complementary products to the core business areas and tax inversions.